Who is Wang Zhongjun?

Dennis Wang, or Wang Zhongjun (王中军), born on November 30, 1960, is a prominent Chinese figure in the realms of business, film production, and art collector. He is recognized as a billionaire entrepreneur who, along with his brother James Wang, known as Wang Zhonglei, established the renowned Chinese entertainment enterprise, Huayi Brothers.

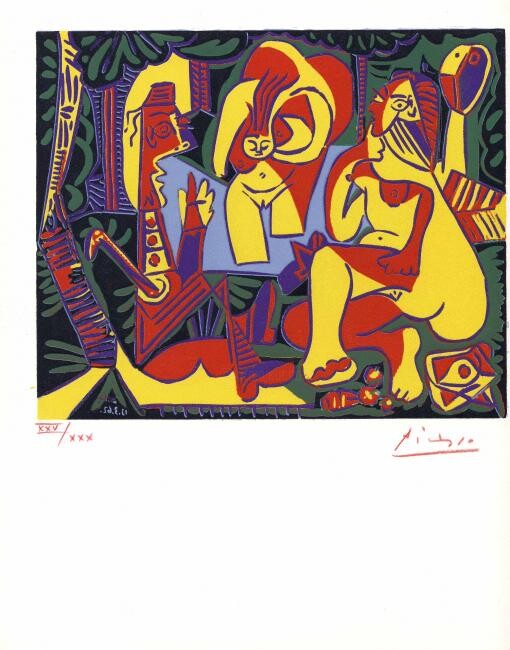

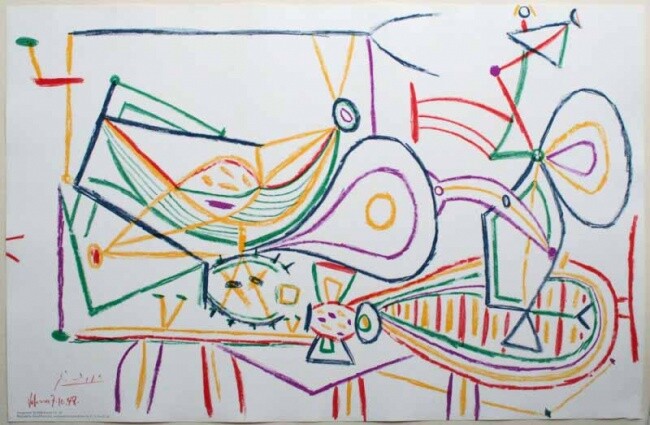

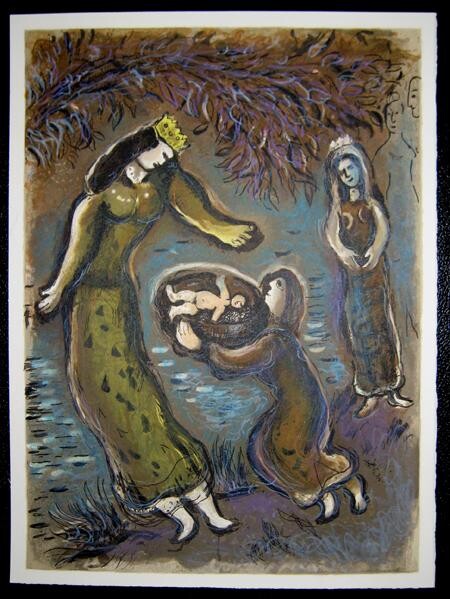

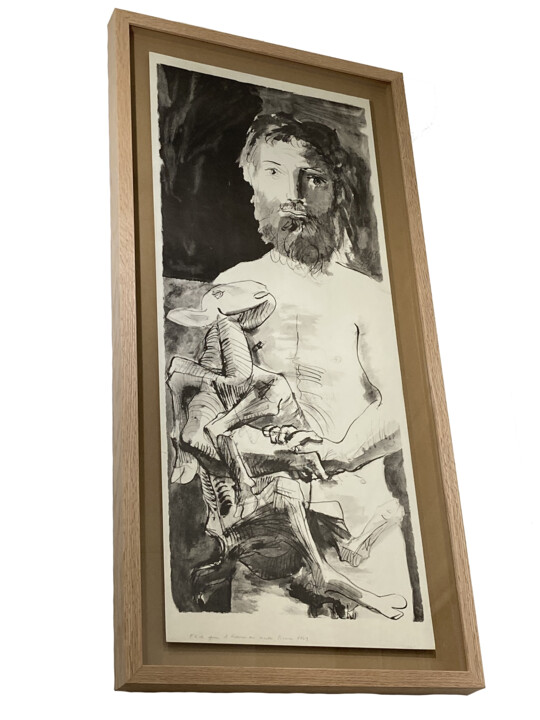

Wang Zhongjun's entertainment company stands as one of the largest in China. His art collection boasts works by both Chinese artists and renowned Western masters such as Picasso, van Gogh, Renoir, and Pissarro, among others. Interestingly, Wang himself is an avid painter, drawing inspiration from artists like van Gogh.

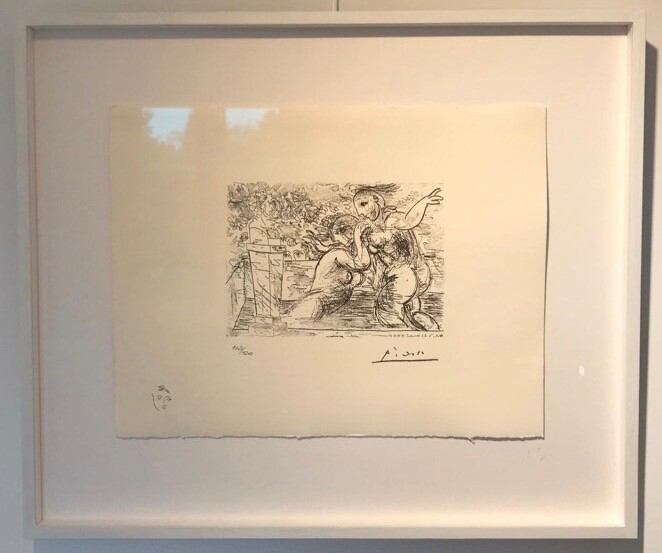

In a significant art acquisition in 2015, Wang Zhongjun acquired Picasso's "Femme au chignon dans un fauteuil" (1948) at Sotheby's for a staggering $29.9 million. This artwork had previously been a part of the collection of the esteemed film producer Samuel Goldwyn Jr. Wang's appreciation for the painting extended beyond its visual appeal; he was equally captivated by its rich history. Following the sale, Wang expressed his sentiments, sharing, "I first fell in love with the painting, and then I fell in love with its story. The Goldwyn family is legendary in our industry.

The Disappearance of a Van Gogh

The bidding for Lot 17 commenced with an initial bid of $23 million. Within the bustling confines of Sotheby's Manhattan auction room, the auctioneer's chant drove the price upward at a rapid pace: $32 million, $42 million, $48 million. Soon, the competition narrowed to just two determined bidders, one of whom was a new entrant participating remotely from China. This memorable evening in November 2014 featured an array of artworks by Impressionist painters and Modernist sculptors, turning the event into Sotheby's most successful auction in its history.

However, the spotlight of the evening was directed towards a specific masterpiece - "Still Life, Vase with Daisies and Poppies" - a painting meticulously crafted by Vincent van Gogh mere weeks before his passing. The bidding soared to an astonishing $62 million, with the victorious bidder hailing from China. This offer marked a historic high for a van Gogh still life at auction.

In the discreet realm of high-end art, the identities of buyers often remain veiled in secrecy. However, the triumphant buyer, a prominent figure in the film industry, chose to publicly declare his ownership of the artwork. This successful bidder, Wang Zhongjun, was riding high on achievements such as his company's involvement in bringing the World War II film "Fury," starring Brad Pitt, to the silver screen. He harbored ambitious aspirations of molding his enterprise into China's equivalent of the Walt Disney Company.

The sale of this van Gogh painting, as reported by Chinese media, created a nationwide "sensation." It signified, following the acquisition of a Picasso by a Chinese real estate magnate the previous year, that China was asserting its influence in the global art market.

Reflecting on his purchase, Mr. Wang remarked in a Chinese-language interview with Sotheby's, "Ten years ago, I could not have imagined purchasing a van Gogh. After buying it, I loved it so much."

However, it appears that Mr. Wang may not be the true owner of the artwork at all. The acquisition of the van Gogh painting was associated with two other individuals: an obscure intermediary based in Shanghai who settled Sotheby's invoice through a Caribbean shell company, and the ultimate authority to whom this intermediary answered—a reclusive billionaire located in Hong Kong.

The billionaire in question, Xiao Jianhua, once stood as one of the most influential tycoons during China's era of economic prosperity. He had built a financial empire in recent decades by leveraging connections with the elite of the Communist Party and the emerging class of ultra-wealthy entrepreneurs. Additionally, he maintained a hidden offshore network comprising over 130 companies, collectively holding assets exceeding $5 billion, as revealed in corporate documents obtained by The New York Times. Remarkably, one of these assets was Sotheby's invoice for the van Gogh painting.

The inherent secrecy within the art world, including the dealings of international auction houses like Sotheby's, has come under scrutiny in the years following this sale, as authorities seek to combat illicit activities. Frequently, substantial transactions involve convoluted intermediaries, and the vetting process surrounding them remains shrouded in obscurity. Sotheby's, citing client confidentiality, has declined to provide any commentary on the purchase.

Today, Mr. Xiao has experienced a dramatic downfall. He was forcibly abducted from his lavish apartment and currently resides in mainland China, where he has been convicted of bribery and other offenses that prosecutors allege posed a threat to the nation's financial stability. Meanwhile, Mr. Wang faces financial challenges, as he is compelled to liquidate properties while his film studio grapples with annual losses.

Remarkably, the van Gogh still life, according to several art experts, has been put up for private sale. For a century after van Gogh artfully arranged flowers in an earthen vase to paint the masterpiece, its provenance remained clear, and the artwork was frequently displayed in museums for the public's admiration. Today, however, the painting has disappeared from public view, and its current location remains a mystery.

The Multiple Chapters in the Life of a Painting

In May of 1890, Vincent van Gogh arrived in the tranquil village of Auvers-sur-Oise, situated just outside Paris. Plagued by deep depression and having famously severed a portion of his left ear a year and a half earlier, his earlier stay at an asylum had yielded little improvement.

However, within a few hours of his arrival in the village, van Gogh encountered Paul-Ferdinand Gachet, a physician with a profound appreciation for art. In a letter to his sister, van Gogh expressed, "I’ve found in Dr. Gachet a ready-made friend and something like a new brother."

Dr. Gachet played a pivotal role in encouraging van Gogh to channel his emotions into his artwork, steering him away from the depths of melancholy. Astonishingly, van Gogh completed nearly 80 paintings in just two months during his time in Auvers-sur-Oise, and among these works, "Portrait of Dr. Gachet" emerged as a masterpiece. It's worth noting that "Vase With Daisies and Poppies," the subject of our discussion, was created at the physician's residence, and some biographers suggest that van Gogh may have exchanged it for medical treatment.

Following van Gogh's tragic death in July 1890, the painting changed hands several times. It first passed to a collector in Paris and later, in 1911, to a Berlin art dealer. As van Gogh's reputation soared, a succession of German collectors became its owners. In 1928, A. Conger Goodyear, an industrialist from Buffalo and a co-founder of the Museum of Modern Art in New York, acquired the artwork. Subsequently, his son George granted partial ownership to Buffalo's Albright-Knox Art Gallery, where it was displayed for nearly three decades.

In May 1990, during a period of record-breaking prices for van Gogh's works, a Japanese businessman set a historic auction record by acquiring "Portrait of Dr. Gachet" for a staggering $82.5 million at Christie's, marking the highest price ever paid at auction for any artwork at the time.

Around that juncture, Mr. Goodyear sought to sell the still life painting, measuring 26 by 20 inches, to fund another museum project. However, it failed to find a buyer at Christie's in November 1990, where it had been expected to fetch between $12 million and $16 million. Eventually, a lower offer was accepted from an anonymous purchaser.

Van Gogh's final years, during which he created some of his most renowned works, produced approximately 400 oil paintings. A significant portion of these masterpieces now resides in prestigious art institutions worldwide. However, approximately 15 percent remain in private ownership and are not routinely exhibited in museums. Over the past decade, a mere 16 of van Gogh's paintings have appeared at auctions, according to Artnet, an industry database. Among these, "Orchard With Cypresses," from the collection of Microsoft co-founder Paul Allen, commanded a remarkable price of $117 million when Christie's sold it last year to an undisclosed buyer.

The Movie Mogul

For a full year following the November 2014 auction, Mr. Wang retained possession of the van Gogh still life, housing it within his opulent $25 million apartment in Hong Kong. In October 2015, the film producer enjoyed the status of the guest of honor at a prestigious five-day exhibition in the city. As an amateur artist himself, he proudly showcased over a dozen of his own oil paintings.

Nevertheless, the undeniable centerpieces of the exhibition were the van Gogh still life and a recently acquired Picasso masterpiece, "Woman With a Hairbun on a Sofa." According to Sotheby's, Mr. Wang had expended nearly $30 million to secure the Picasso.

Until that point, the headlines had predominantly featured Japanese industrialists, followed by American hedge fund managers and Russian oligarchs, making record-breaking art acquisitions. However, around 2012, the emergence of newly affluent Chinese buyers, who had prospered from their nation's market-opening policies, brought a new dynamic to the art world.

David Norman, who once led Sotheby's Impressionist and Modern art department during the van Gogh's sale, recalled, "All the auction houses really jumped on that." Chinese billionaires were often eager to publicize their high-value art acquisitions. In 2013, a retail magnate purchased a Picasso for $28 million at Christie's, following up with a $20 million Monet at Sotheby's in 2015. In the same year, a stock investor disbursed $170 million at Christie's for a Modigliani. Kejia Wu, who taught at Sotheby's Institute of Art and authored a new book on China's art market, noted, "It is a combination of vanity, investment, and building their own brand."

Mr. Wang, at the age of 63, reveled in the limelight. During interviews, he expressed his profound admiration for van Gogh and the artist's profound influence on his life. He remarked, "Few people in the world would buy this kind of painting — there aren't that many who love Impressionist art this much and can afford it, right?"

Shortly after the hammer fell at Sotheby's, Mr. Wang disclosed to a Chinese publication that he had not acted alone in the purchase, although he provided no further specifics. Subsequently, he ceased mentioning any co-investor. In a statement published on Sotheby's website, he recounted his initial connection with the painting: "When I saw the painting at a preview, I just felt like owning it — it stirred my heart."

Transactions of this magnitude, orchestrated through intermediaries and shrouded in secrecy regarding the ultimate source of funds, are the type of dealings that governments have been striving to regulate in recent years.

One notable scandal involved the United States charging a Malaysian businessman with laundering billions of dollars from a state development fund, a portion of which was used to acquire art at Sotheby's and Christie's. In 2020, the Senate released a damning report detailing how auction houses and art dealers unwittingly facilitated Russians in evading sanctions by enabling others to purchase art on their behalf.

A spokeswoman for Sotheby's emphasized that the company thoroughly vets all buyers and, when necessary, engages its compliance department to conduct "enhanced due diligence." Sotheby's adheres to a 2020 European Union regulation that mandates auction houses to verify the legitimacy of funds, applying this standard worldwide.

The owner of the van Gogh

Although the financial records pertaining to the van Gogh transaction do not indicate any illicit activity, the nature of the deal was far from ordinary. Following the auction, Sotheby's officially transferred ownership of the painting to an individual in Shanghai. This individual, not recognized as an established art agent or collector, was the one who settled the bill for the artwork. However, in a public ceremony, Sotheby's did not hand over the painting to this individual or the billionaire who ostensibly employed him. Instead, the artwork was ceremoniously delivered to the producer, Mr. Wang.

Leila Amineddoleh, an art lawyer based in New York, remarked, "There's a connection to someone who is now incarcerated. Something unusual is going on."

The individual whom Sotheby's recognizes as the owner of the van Gogh resides in a Shanghai apartment complex characterized by gray tiles, worn grout, and a weathered door. A doormat placed outside reads, nine times in English, "I am an artist."

This occupant, Liu Hailong, is officially listed as the sole owner and solitary director of the shell company based in the British Virgin Islands that made the payment for the van Gogh: Islandwide Holdings Limited. Beyond basic details such as his date and place of birth, little is known about Mr. Liu, who is 46 years old.

When a reporter recently confronted him with the Sotheby's invoice and a bank wire document, inquiring whether the signature on the documents belonged to him, Mr. Liu responded tersely, "Please leave immediately," and promptly closed the door. Sharing the residence with him is Zhao Tingting, a woman with her own connection to the incarcerated billionaire, Mr. Xiao. She had previously held a high-ranking position at a company co-founded by Mr. Xiao, which engaged in business dealings with relatives of China's top leader, Xi Jinping.

Now, Ms. Zhao, aged 43, who no longer holds her previous position, teaches piano. When questioned about Mr. Liu's acquisition of the van Gogh, she remarked, "Do you think our house comes close to the price of that painting?" She and Mr. Liu consider themselves "just ordinary little employees," asserting that they have no affiliation with the Tomorrow Group, the conglomerate of companies controlled by the billionaire. They claim to possess no decision-making authority and no access to confidential information.

It appears that this couple may have served as "white gloves," a term employed in China to describe proxy shareholders employed to conceal the true owners of companies. Among the extensive documentation encompassing details about the Tomorrow Group, there is a spreadsheet listing numerous individuals fulfilling such roles. At least four offshore companies were registered in Mr. Liu's name.

These companies were integral to Mr. Xiao's expansive business network. He initially exhibited promise, gaining admission to China's prestigious Peking University at the tender age of 14 and assuming a leadership role during the 1989 Tiananmen protests. He aligned himself with the government, a decision that ultimately contributed to his ascent as one of China's wealthiest individuals. He acquired control over banks, insurance firms, brokerages, and held stakes in sectors spanning coal, cement, and real estate.

In contrast to many of the audacious billionaires he conducted business with, Mr. Xiao, now 51, preferred to operate discreetly, cultivating connections with influential figures in China. He led a low-key life at the Four Seasons, where a team of female bodyguards attended to his needs.

The reasons behind one of his subordinates covering the costs of the van Gogh remain unclear. Mr. Wang, the film producer, counted himself among China's wealthiest individuals, although not on par with Mr. Xiao in terms of wealth.

Mr. Xiao's access to offshore funds beyond China's stringent currency controls could have enabled him to function as a financial facilitator for Mr. Wang. Documents reveal that both men were devising art investment plans in the same month as the auction, yet their joint venture, based in the Seychelles, was not established until a year later. In the interim, the two established another offshore company aimed at investments in film and television projects in North America.

Another plausible explanation for the payment could be Mr. Xiao's desire to acquire an asset easily transportable via private jet, evading scrutiny from bank compliance officers and government regulators.

An Abduction, and a Disappearing Act

A Changing Fortunes Linked to the Purchase of the Van Gogh

In 2015, the fortunes of the individuals connected to the van Gogh purchase took a dramatic turn with the crash of the Chinese stock market. The Chinese government, under Xi Jinping's leadership, blamed market manipulation by well-connected traders and began to exert more control over the economy, especially among the billionaire class. Many financiers disappeared and later reappeared in police custody.

This change in the economic climate led to a shift in the art market as well. Art purchases became more discreet, with even high-profile sales like Oprah Winfrey's $150 million Klimt painting being sold to an anonymous Chinese buyer in 2016.

By early 2017, Xiao Jianhua's life as a free man came to an end. He was forcibly removed from his Hong Kong apartment, taken to mainland China, and eventually charged with crimes dating back before 2014, the year of the van Gogh sale. He was sentenced to 13 years in prison for market manipulation and bribery, and his companies in China were dismantled.

The British Virgin Islands business that had bought the van Gogh also changed ownership, with Liu Hailong being removed as its owner. Wang Zhongjun, the film producer, initially maintained a lavish lifestyle, but the market value of his film studio plummeted as it backed unsuccessful projects. He had to let go of much of his art collection, his Hong Kong home, and the Beijing museum that showcased the van Gogh and Picasso paintings.

Today, the van Gogh floral still life, once a vibrant masterpiece, has not been seen publicly for years. However, there are reports that the artwork may be back on the market. Art experts have noted that the painting had been offered for private sale, with a written proposal to buy it for approximately $70 million circulating last year. It remains uncertain whether the painting has been sold or if concerns have been raised about the ownership of the artwork.

In the world of high-value art, where legal ownership is crucial, any doubts about the painting's ownership can deter potential buyers. The $62 million van Gogh could become an unwanted legal liability, prompting potential buyers to opt for a different artwork or investment altogether.

Selena Mattei

Selena Mattei